Learning Resource Centre (LRC)

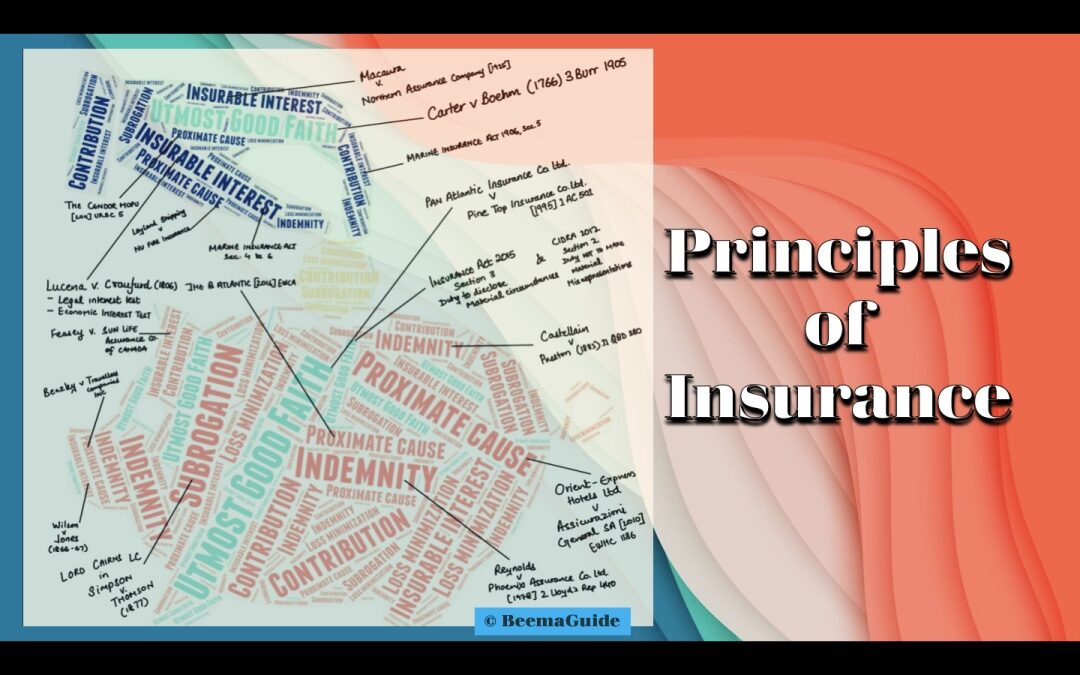

Principles of Insurance

The business of insurance is conducted through principles that form the founding pillars and understanding these principles shall clarify a lot about the insurance process, terms and conditions, as these are the guiding rules.

Insurance Structure

The insurance industry plays a valuable role in securing wealth and supporting the prosperity of society. This industry is a financial structure where every stakeholder creates value for the benefit of everyone. Therefore, it is important to understand its structure.

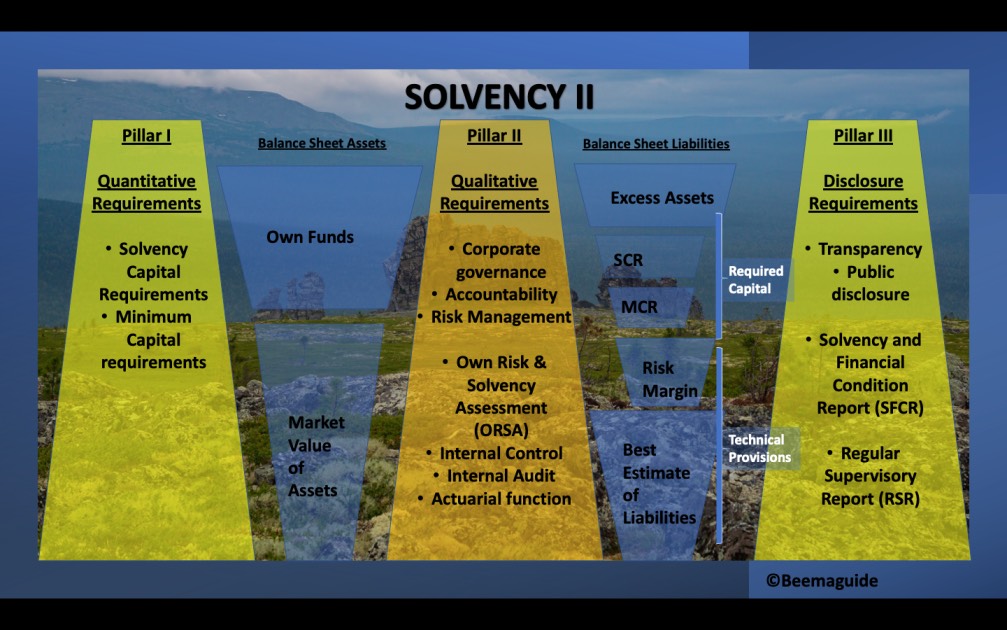

Solvency II Regime

Key takeaway: The 3 pillars of insurance regulation of Solvency II regime. Introduction A regime is an orderly way to do things. The solvency II regime was brought to life by the directive 2009/138/EC of the European Parliament on the business of Insurance and...

Risk

Key Takeaway: Risk Classification and Management “Risk is part of venture but it can be tackled and it should be tackled.” Introduction Most activities have risks associated with them because there is always a possibility of failure. The activities that result in a...

Insurance is a contract

Key takeaway: Insurance contract essentials Insurance is a device to reduce risk and provide security. It divides an individual's loss among a large number, spreading the loss through its mechanism. Insurance is a regulated industry and the regulatory bodies govern...

Know Insurance

Key takeaway: Insurance introduction. Insurance is a method of risk transfer. It is a legitimate system where you may secure yourself against financial losses that may be unforeseen and unexpected. If you lack the means to meet your unexpected liabilities, then you...