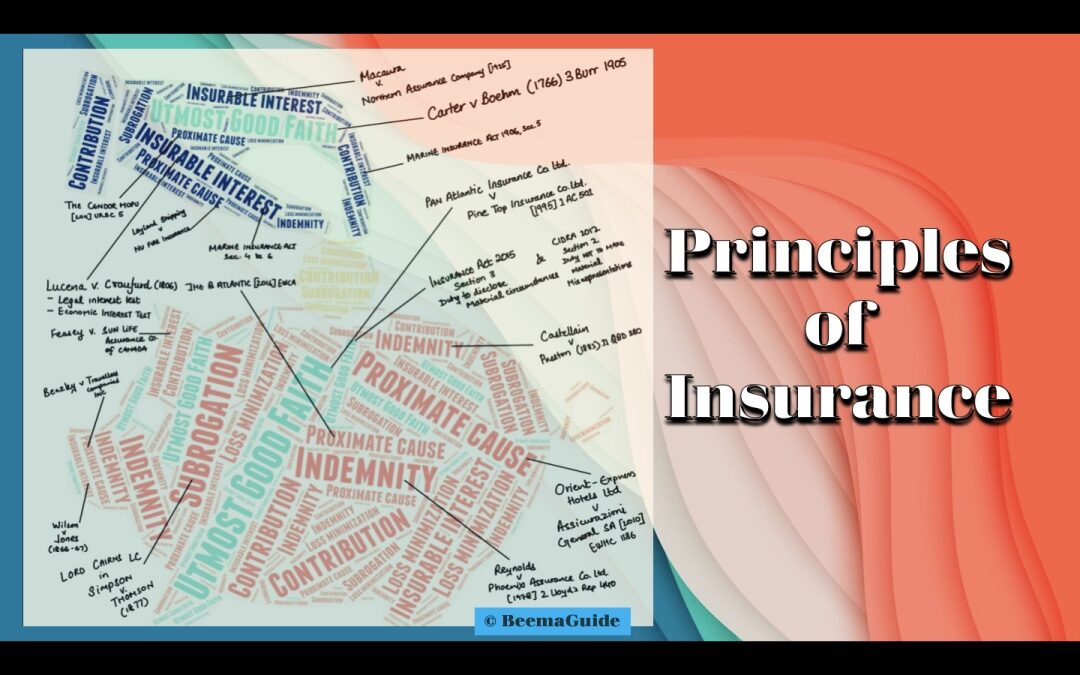

The business of insurance is conducted through principles that form the founding pillars and understanding these principles shall clarify a lot about the insurance process, terms and conditions, as these are the guiding rules.

- Utmost good faith – The risk is underwritten under the utmost good faith that all the relevant information related to the risk has been disclosed by the insured so that the loss can be forecasted accurately. The risk will be rated based on the disclosures by the insured and the appropriate premium will be charged. The duty of ‘fair presentation of the risk’ incidents from the ‘utmost good faith’ principle. It is as per section 3 of the Insurance Act 2015, which defines the duty of fair presentation of the risk. In Carter v. Boehm, it is explained reasonably as follows:

- ‘The special facts, upon which the contingent chance is to be computed, lie most commonly in the knowledge of the insured only.

- The underwriter trusts this representation, and proceeds upon confidence that the insured does not keep back any circumstance in his knowledge, to mislead the underwriter into the belief that the circumstance does not exist, and to induce the underwriter to estimate the risk, as if it did not exist.’

- Insurable Interest – It is a right in the asset or acquired through a contractual agreement about the asset and that right can be lost due to some contingency that can affect the possession, benefit, or enjoyment of the asset. To explain, one can only insure something if he/she has a right to that thing such that if something bad happens to that insured thing the person may suffer financially, and lose the possession, benefit, and enjoyment of that thing. Without insurable interest life insurance is void, and marine insurance is as well. While in property and liability insurance, insurers may not void the complete policy but decline to pay claims. It would be similar to gambling. Insurance is usually for pure risks where loss is certain upon the occurrence of the peril.

- Indemnity – The insurance will only pay out the actual loss amount and nothing more. The insured shall never be more than fully indemnified. Simply put, if you have insurance covering your property for a maximum sum insured of $5 million, and you incurred a loss evaluated at $0.5 Million then the insurance shall only pay out the $0.5 less deductions subject to policy terms and conditions. In case the loss is $ 7 million which is more than the $5 million sum insured, the insurance shall only pay $5 million at max.

- Proximate cause – The insurance shall only cover the losses proximately caused by the perils named in the policy. The proximate cause is the most dominant and effective peril behind the loss and had that not happened the loss would not have occurred. There can be concurrent proximate causes applying at the same time. So where the cause is an insured peril and the other is uninsured then it shall be covered, however, where there is an excluded peril proximately causing the loss then the exclusion will apply irrespective of the other causes being uninsured or insured. The Leyland Shipping 1918 [AC 350] case clarifies the concept as follows:

- The policy covered ‘perils of the sea’ but excluded ‘war risks’

- The insured vessel was torpedoed by a submarine.

- It survived and reached the harbor where it was grounded due to the gale whilst moored in the harbor.

- Sank after 2 days.

- Had the vessel not been torpedoed it would still have survived, therefore the perils of the sea were not the most dominant and effective cause that sank it.

- War risks exclusion applied.

- Subrogation – This principle is used to recover the cost of claims from entities at fault. Once the claim is settled, the insurer steps into the shoes of the insured and have the right to proceed legally, under the name of the insured, against the entity at fault to recover the amount settled for. An example would be home insurers recovering the claim settled amount from the motor insurers of the vehicle and driver that caused the property damage.

- Contribution – This is a principle that applies when the subject of insurance is insured by multiple insurers for the same period against the same peril. The insurers then contribute towards the claim settlement amount. The insurer handling the claim would be required to inform the other insurers and share the details requested by them which are reasonable and relevant for the claim validation and evaluation. An example would be the travel and home insurers contributing towards the theft of personal possessions during the travel. The principle allows resource contribution from both insurers so that the insured is spared of further distress at the time of loss.

- Loss Mitigation – An insurance agreement is to cover the insured against a fortuitous event (usually specified in the policy as perils) causing the loss. The insured must take reasonable care and maintain properties in good condition and repair, and also take reasonable measures to prevent any (foreseeable) loss. This principle requires that reasonable steps must be taken by the insured to minimize the loss.

These principles have been formed after years of insurance practice. I have merely introduced them to you. There is a lot to learn about these principles through case laws and how they have developed over the years. Keep an eye on my posts to learn more in detail about these principles of insurance.